Advantages and Disadvantages of Share Trading Platforms UK

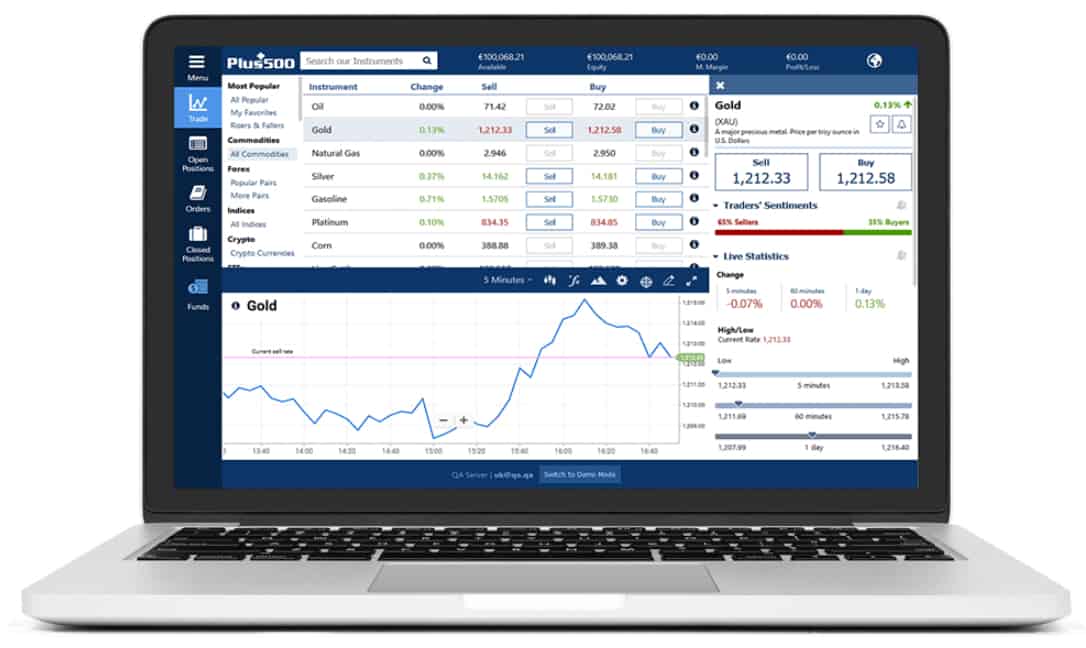

Trading platforms UK offer users real-time insights on news and market research. Users are informed about market conditions and financial information, which saves them time and effort. The platforms also offer various analytical tools including interactive charts, timeframes, analytical objects and technical indicators. These tools help traders to recognize market trends and time-based market entry. Customers can also take advantage of risk management tools that are customized to meet specific needs.

Some platforms charge an account fee however, this fee could be either a fixed monthly fee or a percentage of the portfolio. Customers should also think about the Financial Services Compensation Scheme. This government-funded scheme protects their investment from any unforeseeable financial crisis. In the event of a trading platform failing the customers are protected by the scheme.

Another advantage of using a UK trading platform for trading is the tax benefits it provides its users. Stocks ISAs can be accessed by UK residents. This account allows users to invest up to PS20,000 per year. These investments are tax-free. In the UK there are numerous trading platforms to choose from.

Interactive Investor Limited is a top flat-fee brokerage, with more than one million customers. It is a great choice for those who are new to the market. It is simple to use and requires no specific minimum deposit. trading platforms uk works with mobile devices and is a flexible service. It allows users to leverage up to 30%.

CMC Markets is a great UK trading platform. It provides a wide range of trading features and is completely customizable. CMC Markets was founded in 1989 and is a pioneer broker. The company is controlled by the Financial Conduct Authority, which makes it a safe choice for capital investment. The company provides more than 9,500 CFD instruments.

CFDs are provided by a number of UK trading platforms. These enable traders to trade shares and buy or sell them. CFDs let traders use leverage, which can increase their profits or reduce losses. The risks are very high with CFDs, so careful analysis of your investment strategy is crucial. Always consult a financial advisor before trading.

These platforms come with similar costs as traditional share investments. Some platforms charge variable commissions while others charge fixed commissions. If you trade a small amount of shares, the charges are usually lower. Certain platforms charge a minimum commission. eToro is a top UK trading platform.

A good share trading platform should have the tools needed for traders to make decisions quickly and easily. It should offer real-time market updates, as well as market analyses from brokers. This will enable you to make educated decisions and minimize your risk. It should include options to purchase and sell shares and create stop-loss orders.